Simply Free Plus checking. $1000 minimum to open (when activity requirements met). Balance: Interest Rate: APY. $0.01 to $100,000: 0.70%: 0.70%: Over $100,000. Accounts, Savings Accounts, Certiicates of Deposit (CDs) and Retirement Accounts at Union Savings Bank. We may deduct these charges from your Account. This document also describes additional terms that govern the payment of interest on your Union Savings Bank Checking Account, Savings Account, Certiicate of Deposit (CD) and Retirement Account. Interest Rates - Deposit Interest Rates - Loans and Advances Interest Rates for NRIs Fees and Services Nomination Facilities Information regarding COVID - 19 Others. And when you open a savings account online, you’ve got options to choose from. Whether you want to earn 5X the national average savings rate with 360 Performance Savings™, or help your kids learn the power of saving with a Kids Savings account, it’s easy to find an account that works for you.

Grow your balance over time

Choose from a range of interest-earning savings options to fit your needs, timeline, and risk tolerance.

Simply Savings

A basic savings account that offers the flexibility to easily deposit and withdraw money.

Simply Savings Student

An account specially designed for those 25 and under, with no maintenance fee.

Union Money Fund

A savings account with the opportunity to earn higher interest and write checks.

Value Edge Money Market

Earn higher interest on balances over $10,000 with easy account access.

**Available to persons age 25 and younger. Annual Percentage Yield (APY) accurate as of the effective date in the deposit account rates. Rate may change after account opening and fees may reduce earnings. Requires enrollment in RoundUp, we will match up to $10 of your RoundUp deposits posted within 60 days enrollment.

| Minimum Opening Deposit | Monthly Fee | Age Requirement | Earns Interest; see current rates | Six free withdrawals per statement cycle | |

|---|---|---|---|---|---|

| Simply Savings | $25 | $3; waived with a $100 average balance | ✗ | ✓ | ✓ $5 for each additional |

| Simply Savings Student | $25 | ✗ | 25 and under | ✓ | ✓ |

| Union Money Fund | $50 | $5: waived with a $1000 average available balance | ✗ | ✓ | ✓ Ability to write checks |

| Value Edge Money Market | $10,000 | ✗ | ✗ | ✓ | ✓ $25 for each additional withdrawal or check |

15-Month Access CD

Get 0.50% APY* on new money to UBT

If rates rise or you just need to access your money, you can do it as often as once a week. Only new money to UBT eligible with a $10,000 minimum to open.

*Annual Percentage Yield (APY) is based on quarterly compounding. $10,000 minimum initial deposit with $1,000 minimum balance required. Minimum withdrawal of $1,000. Withdrawals may be made without penalty every 7 days. Withdrawals made within 6 days of opening or following a withdrawal will be assessed a penalty, which may reduce earnings. Not available for Public Funds.

UBT HSA

Start saving for tomorrow’s healthcare expenses today

Our health savings accounts offer a triple tax advantage — and room to grow.

Your Money Has People

Real people who really care

Our people take pride in going the extra mile to help our customers, so you can relax knowing we have your best interests in mind. Beyond savings accounts, you’ll find a full range of services to help you grow your wealth — backed by real people, like Lauren.

Fee Relief

With $10,000 in combined personal accounts (HSAs excluded), your debit activity fees and return deposited item fees are waived on your personal checking accounts.

ATM freedom

Enjoy free, unlimited use of all non-Union Bank ATMs as well as Union Bank ATMs.

(Note: This does not waive surcharges some ATM owners may assess.)

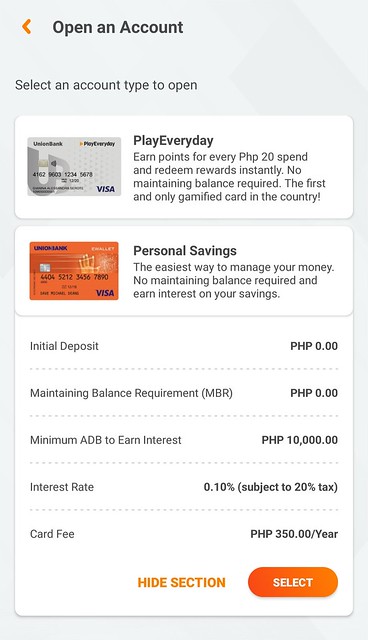

Union Bank Savings Account Interest Rate Philippines

It’s automatic

Each month, we automatically check to see if you qualify — you don’t have to sign up. Applies where the primary account holder is the same on the qualifying deposit accounts and checking account.

RoundUp

An easy way to save

Automatically round your debit card purchases to the next dollar (or an amount you choose) into your savings account. It's easy and free! Sign up at any UBT location.

The fastest way to add someone to your account would be to stop into any branch location with them.

Union Bank Money Market Rates

We are not able to remove an account owner; a new account would need to be opened.

We require a signature from an account owner to close an account. The fastest and simplest way is to stop into any branch location.

Savings account statements are rendered quarterly. If you have a checking account and have elected for combined statements then you will receive a statement monthly.

Union Savings Bank Cd Rates

A checking or Savings account will become inactive after 12 months of no credit or debit activity.

Regulation D (Reg D) is a Federal Reserve Board rule that puts a limit of six transactions per month on certain transfers and withdrawals from your savings or money market account. If you go over the limit, UBT can charge you a fee and/or close your account or restrict transactions. Reg D is the federal government's way of encouraging people to use saving accounts as they are intended---to save money---and ensures that banks have the proper amount of reserves on hand.

Which transactions are limited under Reg D?

- Online transfers from savings or Money Market accounts to a different account either at the same institution or a different one

- Transfers processed over the phone

- Automatic or preauthorized transfers, such as bill payments or any other recurring transfers

- Overdraft transfers from your savings account to your checking account

- Transfers made by check or debit card.

Which transactions don't count under the limit?

- Withdrawals or transfers made at ATMs

- Transactions made in person at a bank

Quick tips on avoiding Reg D fees/violations

- Make transfers count; do fewer transfers with larger sums of money

- Link any automatic transfers, such as bill payments, to your checking account instead of savings

- If you hit the transaction limit and need to make another transfer or withdrawal from your savings account, do it at an ATM or bank. Even if the bank charges a fee, you won't risk your account being closed.

- If your checking account has overdraft protection linked to a savings account try to avoid overdrafts. Set up low-balance alerts on your checking account.

At Union Bank, we notify our customers by letter each time the violate the regulation in hopes they will explore other ways to avoid going over the transaction restriction but if this is not done our only option is to restrict the transfers and/or close the acct.

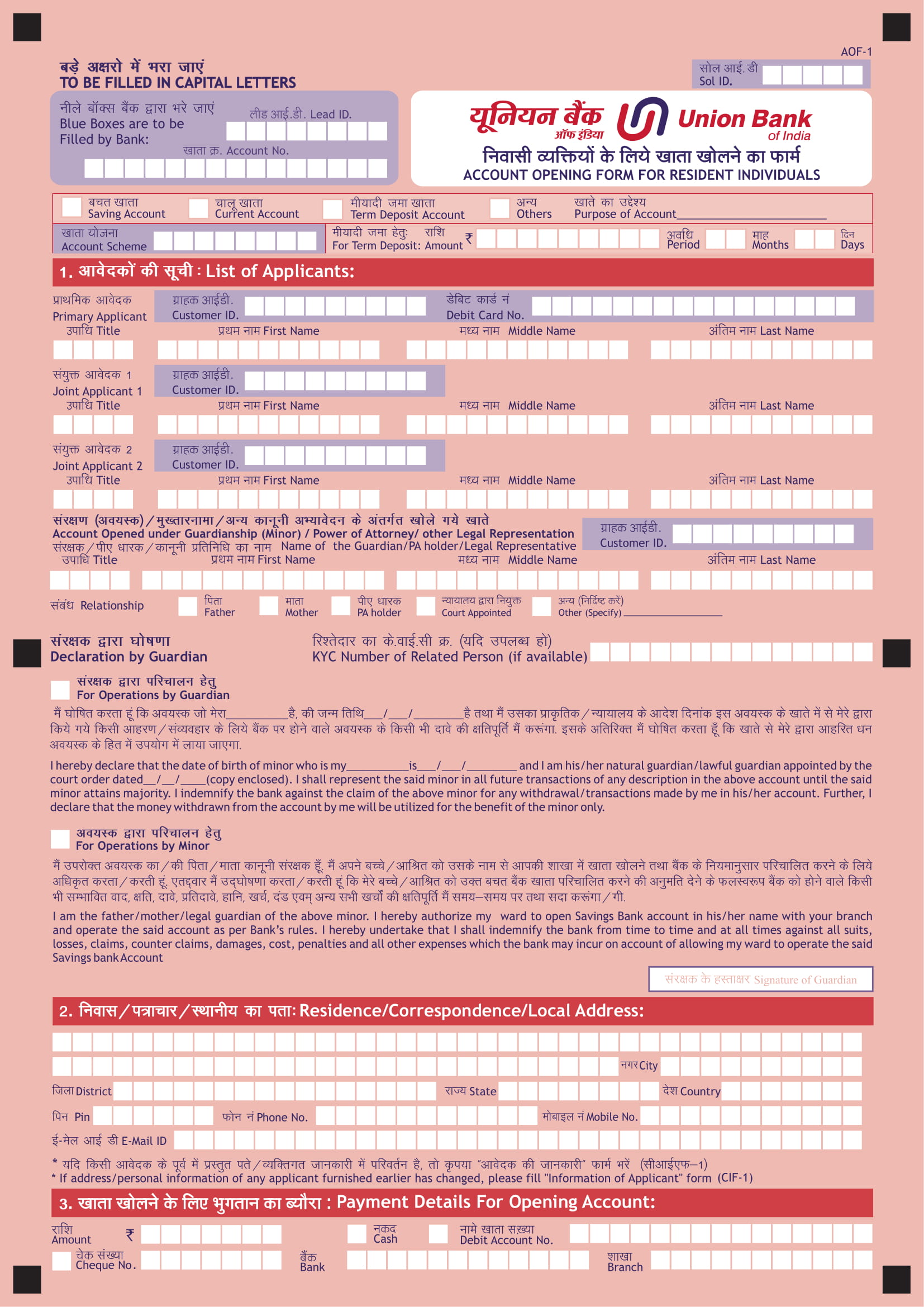

Union Bank Deposit Rates

For more information regarding Regulation D, please click HERE to view a document from the Federal Reserve regarding this regulation. The information as it relates to Savings accounts begins on page 3.